“Accidental landlords” should be especially aware of this because you own the property and are only renting it out for a short time, you might be tempted to pay for things out of your personal account, but if you go that route, you’ll pay for it come tax time. That is not only a huge waste of time, but if you don’t separate them properly, you’ll also end up losing out on business-related deductions - and paying more taxes as a result.

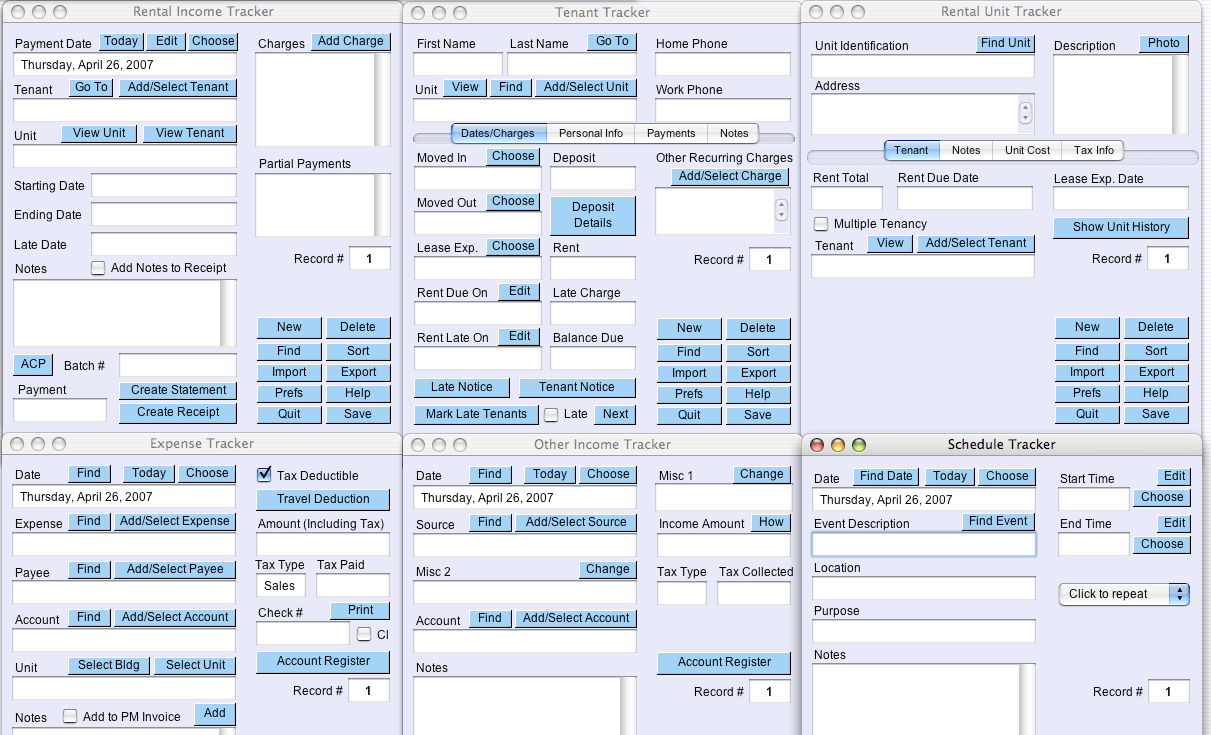

Rental property owners often mix their personal and business finances because it seems more convenient rather than trying to manage multiple accounts, they figure they’ll just pay for their rental property expenses out of their own pocket and worry about separating things later.īut conducting business like that is a mistake. The first tip for keeping your finances in order is to keep your personal and business accounts separate. Here are nine tips to keep your finances in order (and keep the tax man happy when April rolls around): Keep Your Personal and Business Accounts Separate When your finances are in order, your business runs smoothly - and tax season is a breeze.īut when they’re not in order? It can lead to costly mistakes - and trouble with the IRS. With the right accounting system, it’s easy to keep your finances in order. And if you own multiple properties, it gets even more complicated.

BEST EXPENSE TRACKER FOR RENTAL PROPERTIES PROFESSIONAL

There’s payments coming in (like rental payments) and payments going out (like repairs, maintenance, professional tenant screening, and background checks). When you own rental properties, there is a large number of financial transactions to keep up with. Getting Started in Real Estate InvestingĪs a real estate investor, there are a lot of things you need to stay on top of to ensure the success (and profitability) of your investments you need to keep your properties well maintained, you need to find responsible and trustworthy tenants, and you need to hire the right property management team.īut one of the most important things you need to stay on top of as an investor? Your rental property accounting.Īs an owner of rental properties, it’s crucial that you keep accurate financial records and stay on top of your accounting.

0 kommentar(er)

0 kommentar(er)